Get the free indiana form m 203

Show details

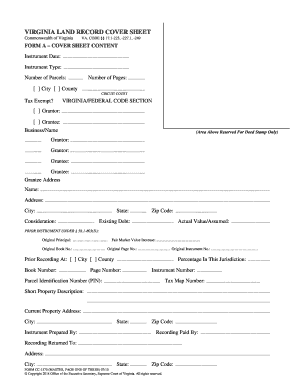

Indiana Department of Revenue Form M-201 Oversized/Overweight Permit Service Procedures State Form 47899 (R4/ 11-07) Date, 20 Legal Company Names: (Hereinafter referred to as the Permit Service).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your indiana form m 203 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana form m 203 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indiana form m 203 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit indiana form m 203. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out indiana form m 203

How to fill out Indiana Form M 203:

01

Begin by entering your personal information at the top of the form, including your name, address, and Social Security Number.

02

Next, provide information about your employer, including their name, address, and Federal Employer Identification Number (FEIN).

03

Fill out the section regarding the type of health plan you have. Check the appropriate box to indicate whether it is an HMO, PPO, or other type of plan.

04

Indicate your coverage period by entering the start and end dates in the designated fields.

05

If your coverage changed during the year, or if you had multiple employers, provide the necessary details in the section titled "Part II: Employee Offer and Coverage."

06

Complete the final section of the form, which requires your signature and date. Make sure all the information provided is accurate and up to date before signing.

Who needs Indiana Form M 203:

01

Indiana residents who are employed and have health insurance coverage through their employers.

02

Individuals who experienced a change in coverage during the year or had multiple employers.

03

Anyone who needs to accurately report their health insurance information to the state of Indiana.

Fill form : Try Risk Free

People Also Ask about indiana form m 203

What is the overhang law in Indiana?

How much is a wide load permit in Indiana?

What is the widest load without permit?

What are the requirements for an oversize permit in Indiana?

How much is an overweight ticket in Indiana?

What are the oversize restrictions for holidays in Indiana?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is indiana form m 203?

Indiana Form M 203 is a form that is used to report the total amount of Indiana corporate income tax due. The form must be completed and submitted to the Indiana Department of Revenue along with any applicable payment.

How to fill out indiana form m 203?

To complete Form M-203, you must first gather the necessary information. You will need your Social Security number and the Social Security numbers of any dependent children. You will also need your income and deductions information, including wages, salaries, dividends, interest, and any other forms of income.

After you have gathered the necessary information, you can begin to fill out the form. Start by entering your Social Security number and the Social Security numbers of any dependent children. Then, provide your name, address, and filing status.

Next, provide your income information, including wages, salaries, dividends, interest, and any other forms of income. Be sure to include any income earned from a business or farm. For deductions, you can check the applicable boxes and enter the amounts.

Finally, review the entries you have made and sign the form. Once you have completed the form, you can mail it to the Indiana Department of Revenue.

What is the penalty for the late filing of indiana form m 203?

The penalty for the late filing of Indiana Form M 203 is 5% of the tax due for each month or fraction of a month that the return is late, up to a maximum of 25%.

Who is required to file indiana form m 203?

According to the Indiana Department of Revenue, individuals or entities that have received or accrued income from Indiana sources and are required to file federal Form 1065, 1120, or 1120S are also required to file Indiana Form M-203.

What information must be reported on indiana form m 203?

Form M-203 is used by businesses in Indiana to report their annual income tax liability. The information that must be reported on Form M-203 includes:

1. Business Information: The legal name, mailing address, federal employer identification number (FEIN), and business type (e.g., sole proprietorship, partnership, corporation).

2. Income/Expense Information: The total income earned by the business during the tax year, including sales, rents, royalties, interest, dividends, and other sources. Deductions and expenses related to the business activities should also be reported.

3. Net Operating Losses: If the business experienced a net operating loss during the tax year, the details of the loss should be reported, including the amount and the year it was incurred.

4. Credits and Payments: Any tax credits or payments made by the business, such as withholding taxes, estimated tax payments, or certain other tax credits, should be reported.

5. Calculation of Tax Liability: The applicable tax rate (based on the entity type), the tax liability calculation, and any penalties or interest owed should be included.

6. Signature and Certification: The form must be signed and certified by the responsible party or authorized representative of the business.

It's important to note that the specific requirements may vary depending on the type of business entity and the nature of its activities. It is advisable to consult the instructions provided along with the form or seek professional assistance when filling out Form M-203 to ensure accuracy and compliance with Indiana tax laws.

When is the deadline to file indiana form m 203 in 2023?

The deadline to file Indiana Form M-203 in 2023 is on or before April 17, 2023. However, please note that this answer is based on the general tax filing deadline for individuals in the United States, which is typically on April 15th. It's always recommended to check with the Indiana Department of Revenue or a tax professional for the most accurate and up-to-date information regarding specific state tax filing deadlines.

How do I execute indiana form m 203 online?

pdfFiller makes it easy to finish and sign indiana form m 203 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my indiana form m 203 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your indiana form m 203 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit indiana form m 203 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like indiana form m 203. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your indiana form m 203 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.